January 2021 Property Index

Market Review

National house price inflation was 3.5% as at the end of January 2021. Contrary to expectations housing prices did not crash

during the year. In fact, the property market recovered as shown by the value bands except for the Low value market which has

seen some correction.

At this point it is difficult to point to the exact reason for the increase in the higher value segments and the decrease of the low

value segment. One reason for the growth in the higher value segments could be the exceptionally low interest rate increasing the

demand, whereas the low value segment which is more dependent on economic growth has taken a big hit from the currently

sluggish economy.

Provincial Inflation

The Lightstone Provincial Index tracks annual inflation of all provinces in South Africa.

Latest/Current Provincial Inflation Status

Municipal Inflation

The Lightstone Municipal Index tracks annual inflation at a municipal level, with coastal and inland based municipalities

reviewed independently.

Property Inflation: Free Hold vs Sectional

Property Inflation: Value Bands

The Lightstone Area Value Bands Index reviews inflationary rates for property based on the following values.

Luxury: > R1.5mil

High Value: R700k to R1.5mil

Mid Value: R250k to R700k

Low Value: <R250k

Inflation Table

The Annual Inflation Table (below) provides a long term view of annual rates of inflation for various geographical areas and

property types. Please note that historic inflation rates can change as transactions occur that imply price inflation for those

periods.

Shining A Light On Our Approach...

Methodology:

Lightstone applies the repeat sales methodology when reviewing and reporting on property data.

In contrast to 'average house price' indices, repeat sales indices provide a measure of the actual

price inflation of houses that have transacted twice within a particular period of time. The main

benefit of this is that it is less influenced by the mix of transacting properties. The repeat sales

methodology is recognised as the premier methodology for indexing house prices and is used by

many international residential property price indexers including the Office of Federal Housing

Enterprise Oversight (OFHEO) in the United States.

Data:

All property transactions in South Africa are registered in the Deeds Office and each record

contains the legal details of both the property and the transaction. For the purposes of the Repeat

Sales Index for residential properties, the following transactions have been excluded: farms; any

transactions which may be of a development, commercial or community services nature; new

developments; sales made in execution of a judgement; non-arms-length transactions;

transactions where the inflation is extremely different to the norm of the statistical distribution of

inflation rates; and township transactions.

Caution:

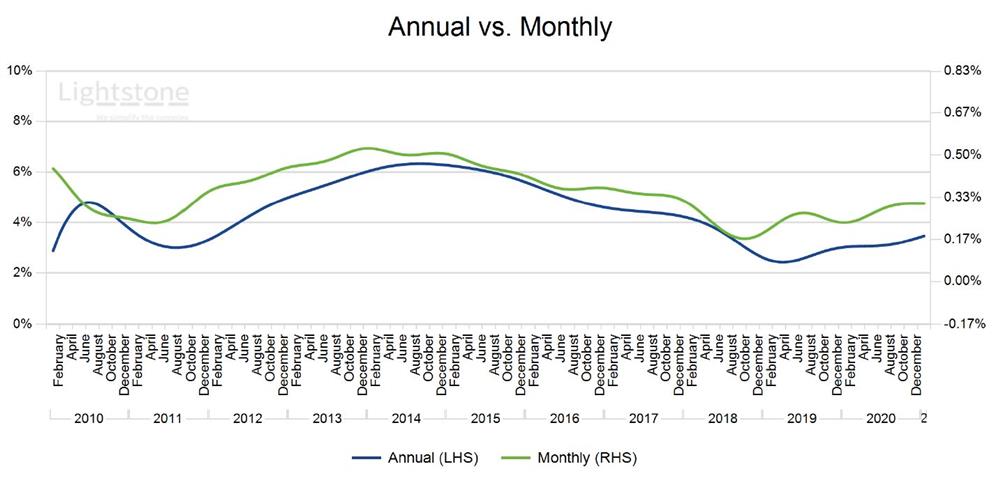

Lightstone presents both annual and monthly inflation rates. Monthly inflation emphasises recent

market performance (i.e. month on month) and is more volatile than annual inflation trends.

Conclusions about the future trend of annual inflation, based on monthly inflationary rates, must

be made with caution.

Disclaimer:

The Lightstone Repeat Sales Index system applies advanced statistical methods to a

comprehensive property database - compiled from the Deeds Office, the Surveyor General and

other sources - to generate repeat sales inflation data for individual residential properties. Despite

the statistical and actuarial rigour applied, Lightstone cannot guarantee the accuracy and

reliability of the data. Furthermore, the index is a statistical tool and does not amount to advice

and may not be applicable in some cases. Lightstone does not take responsibility for any losses

incurred as a result of any person acting or omitting to act as a result of the publication of this

index.

Queries:

Should you have any queries, please do not hesitate to email us info@lightstone.co.za or give us a call on 0860 106 389